Some Arguments For Getting Long F5 Networks (FFIV)

Upon searching some stocks that perform well seasonally (via the PPT) for the month of October there was one stock that shot to the top; F5 Networks (FFIV). I like to perform these seasonality scans at the beginning of the month and then compare where the stock is to its statistical average. I also like to look at the current chart to see if it has a technical advantage as well.

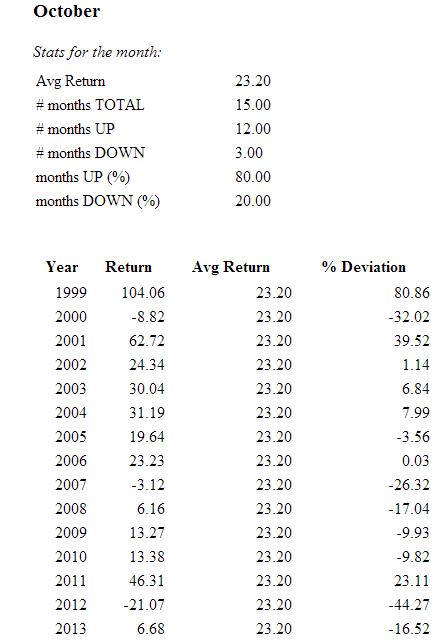

Below is a screenshot of the seasonality for this stock and we can see that FFIV is the Mr. October of stocks. FFIV has an average return of 23.2% with 15 data points and a 80% probability of a positive performance.

Digging deeper into October we can see its performance for that month alone.

Looking at this set of data we can see that we are still negatively deviated from the avergae October return despite its positive return for the month. Also last year seemed to be the anomaly for return so maybe there will be a snapback this year (hypothetical though). One argument I have to the seasonality is the tech bubble and where we are now. As you can see FFIV had enormous returns during the early 2000’s but has been calm from the financial crisis and on. In my opinion I would focus on the last 5 yreas and gauge the return based on those recent years. Either way the return has been positively well and current price is still deviated.

In regards to technical analysis I believe FFIV is ripe for the picking. When looking at trades beyond a swing I go right to the weekly as this is what institutions will look at as well. Notes are on the weekly chart but I really like this setup here and would use the daily to pinpoint the entry. Also we can see that FFIV is not overextended and has room to run and find memory to the upside.

Weekly Chart with notes:

Daily chart with notes:

The volatility chart (with notes) shows that we may see more volatility expecting a move to the upside based on seasonality, where price is now, and that a move is coming.

With this keep in mind your timeframe. I mainly trade options so if I were looking for a play I would use a spread (vertical, butterfly, etc.) going to November expiration and if I were playing a naked call/put I would go to December expiration based on time decay and the seasonally favorably of November.

Leave a comment