Upon searching some stocks that perform well seasonally (via the PPT) for the month of October there was one stock that shot to the top; F5 Networks (FFIV). I like to perform these seasonality scans at the beginning of the month and then compare where the stock is to its statistical average. I also like to look at the current chart to see if it has a technical advantage as well.

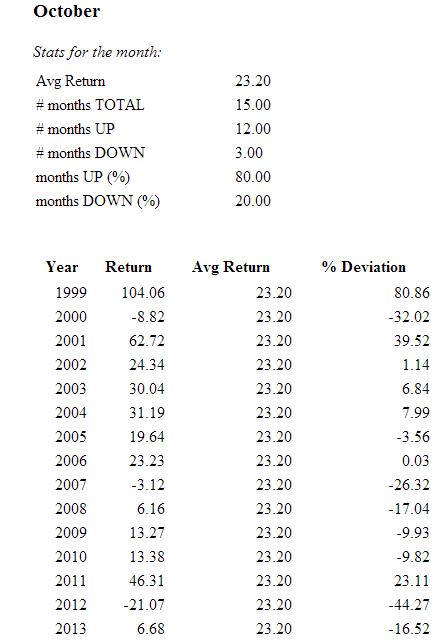

Below is a screenshot of the seasonality for this stock and we can see that FFIV is the Mr. October of stocks. FFIV has an average return of 23.2% with 15 data points and a 80% probability of a positive performance.

Digging deeper into October we can see its performance for that month alone.

Looking at this set of data we can see that we are still negatively deviated from the avergae October return despite its positive return for the month. Also last year seemed to be the anomaly for return so maybe there will be a snapback this year (hypothetical though). One argument I have to the seasonality is the tech bubble and where we are now. As you can see FFIV had enormous returns during the early 2000’s but has been calm from the financial crisis and on. In my opinion I would focus on the last 5 yreas and gauge the return based on those recent years. Either way the return has been positively well and current price is still deviated.

In regards to technical analysis I believe FFIV is ripe for the picking. When looking at trades beyond a swing I go right to the weekly as this is what institutions will look at as well. Notes are on the weekly chart but I really like this setup here and would use the daily to pinpoint the entry. Also we can see that FFIV is not overextended and has room to run and find memory to the upside.

Weekly Chart with notes:

Daily chart with notes:

The volatility chart (with notes) shows that we may see more volatility expecting a move to the upside based on seasonality, where price is now, and that a move is coming.

With this keep in mind your timeframe. I mainly trade options so if I were looking for a play I would use a spread (vertical, butterfly, etc.) going to November expiration and if I were playing a naked call/put I would go to December expiration based on time decay and the seasonally favorably of November.

One of the things that I have loved about technical analysis is that it can be really objective. Lately it seems that the McClellan Oscillator has gained popularity and it is one indicator that I have liked to use. Just go to my search box and type in McClellan and you can see that I have written about it many times. Ever since our first dip below -200 on the McClellan I was anticipating a divergence in the SPX and the McClellan Oscillator. As shown below we have that now:

Previously I have written about McClellan positive divergences with highlights on the chart and can be found below:

What am I saying here? The hardest thing about trading is anticipating what the fundamental or economic data means in the long run. This is one reason I like history and I like technical analysis, looking back I can see divergences in the market (via SPX) and the McClellan Oscillator has led to positive returns.

Does this mean the bottom is in; not by any means. It just tells me as a manager of risk that I would rather leg into longs rather than shorts or just be in cash and let things settle out. Don’t ever forget that selling can lead to more selling despite what any technical indicator tells you and it is the professionals of risk management that will prevail.

Having some free time I opened up my TOS Desktop software to try and solve a problem I have when scanning for stocks. I hate when I want to get long/short a stock but find out that it has earnings within the next two days or any other number in where I am looking to hold for a longer period of time. One example can be $AAPL. I want to put on bull put spreads but do not like the fact that it has earnings April 23rd. This can be true for many stocks when you run a scan and find stocks that fit your criteria but they have earnings coming up, personally I just toss those aside unless it is an earnings specific strategy. Now I wanted to try and get a scan that can cast those aside as to not crowd the scan or where I don’t have to pre-filter the scan by going to other websites. I looked on the web but could not find a solution for this so I tried to figure one out.

Going to the Scan Tab I opened up TOS’s source code for Earnings. The problem is that this only searches for stocks with upcoming earnings within the selected amount of days (default is 10) but DOES NOT look for those that already had or does not have earnings within a “X” amount of days. I believe I was able to use their code and supplement some stuff and have figured out a way to search for stocks that have no upcoming earnings with the user able to select the amount of days. I will try to break this down by the numbers:

1) TOS users can start by opening up their Desktop App and then going to the Scan Tab.

2) Then go to the “Add Study Filter” box to the right and click on it. This adds and defaults to the “ADX Crossover” box which is added to the bottom of your filter:

3) Click on the “ADX Crossover” box and scroll down to “Corporate Actions and then over to “Earnings” and the following should be displayed:

4) Next click on that pencil to the right of the “D” and to the left of the “Red X”. This opens up your script to where you can edit it with the “thinkscript Editor” Tab (as shown below):

4) Highlight the entire text and delete it. Then paste the following in bold red text :

#Wizard text: Has an earnings annoucement

#Wizard input: Choice

#Wizard text: in the next

#Wizard input: length

#Wizard text: bars

Input length = 20;

input Choice = {default “Any time”, “Before the Market”, “After the Market”};

def earnings = hasearnings();

def scan;

switch (Choice){

case “Any time”:

scan = sum(hasearnings(),length)[-length +1] > 0;

case “Before the Market”:

scan = sum(HasEarnings(type = EarningTime.BEFORE_MARKET),length)[-length +1] > 0;

case “After the Market”:

scan = sum(HasEarnings(type = EarningTime.AFTER_MARKET),length)[-length +1] > 0;

} ;

def x = if(scan,1,0);

plot NoUpcomingEarnings = x == 0;

5) Hit “OK” and then that should work.

I have this set at 20. But you can easily edit it by going to Line #7 at the “Input length” and change that number to anything you wish. Keep in mind it looks for stocks that DOES NOT have earnings in those next amount of days, in this case does not have earnings in the next 20 days. You can then add other filters that fit your personal liking such as price higher than or volume average greater than to further filter it down.

I am not a programmer or coder but just make my own scans as best I can and puzzle stuff together to achieve my goal. I could not find anything else on the internet but if you have a better way just let me know. I just wanted to share this with traders that had the same kind of annoyance that I experienced with finding stocks that fit scan criteria only to find they have earnings soon. Hope this helps.

I write this post with bitterness at helm. This week has left little time to concentrate on markets and instead figure other things out as I knew changes were at hand. Today I just found out I will lose a trading edge attributed to causes mentioned in this post. For the last 3 years in my full-time job I was detailed to a rotating night shift that left me with the availability to do market research at night and trade the markets during the day.

Today I learned that I will no longer have this edge as of Thursday morning I will now be required to work a day shift starting at 6am and working until an unknown time Monday-Friday. This requires me to completely change my strategy as I like to swing trade in options and be frequent to the monitor as I do not rely on limit orders whether in stocks or options.

Now I ask my myself what to do? I love trading and the markets in general. But being away during most of the day leaves me without conversation via social media or in the know until after hours and that sucks as I always liked participation but recent events have left my concentration elsewhere.

While some of you may say trade via limit orders or alerts, I have never trusted these without my own eyes on the situation, ie. ISRG. So now I will try to develop some sort of strategy in long-dated options expiration or in the indices that have lower volatility. I can also look to go back to some pairs trading as well. Either way an adjustment needs to be made and overall this sucks as I know I will be out of the game more than usual for at minimum several months.

Either way it has been fun to be in contact with traders via Twitter/Stocktwits and will try to be as active as possible but these new hours will definitely hinder future engagements.

If you have followed or read my blog I thank you and I will try to to keep updated as much as possible. For right now current obligations will hinder frequency.

No market comments here just a story for the day. After the market close I drove around town(s) collecting some goods for the week. This is when I thought “damn some bratwursted sausages sound good.” So I purchased them from the store and then got home and fired up the Weber charcoal grill, no gas grills at my place.

The problem with the weather here in PA today was that it was mid to high 30’s during the day and raining/sleeting. Miserable weather but I had to have the grilled bratwursts. So I grilled at the edge of the opened garage door as I often do when weather messes up my grilling efforts. I ate the delicious grilled bratwursts and then later in the night proceeded to the garage where it was time for the weight portion of the workout followed by the pushups-situps-pullups routine.

I didn’t want to leave the garage door open for reasons of the weather and I don’t like people looking in my garage while I workout as this in the past has attracted beautiful women that disrupt my routine. So I had to make a decision: put my grill out in the rain or bring my grill inside not thinking the burning coal would do much harm as the coals were dying down. I chose to bring the grill inside.

Throughout the workout I was feeling slightly light-headed but not a crazy unusual occurrence and I was also having a harder time focusing and was more short of breath than usual. I attributed this to a late night of research and an early wake coupled with current exercise. Meanwhile I didn’t really acknowledge the fact that I brought the grill in and this was emitting carbon monoxide.

After completion, about 40 minutes, I went in the house and I was dizzy, light-headed, and exhausted. This is when it occurred to me that the damn grill was slowly poisoning me and I probably was in a deadly toxic environment while pushing my body to exhaustion. So in the process I probably lost some brain cells but in the end it was a good workout and I really enjoyed those bratwursted sausages on a grill that continues to remain rust free.

*I will attribute any future stupid trade decisions to this incident and loss of those brain cells.

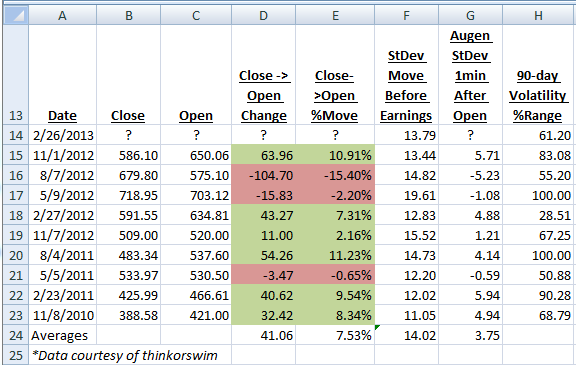

Priceline reports 2/26 AMC. Below is a history of PCLN EPS/Revenue estimates and actual reported numbers. PCLN has a history of beating on EPS and revenues except for a couple misses in 2012 and one in 2011.

Looking at competitors of PCLN that have recently reported can give us some insight on expectations of price action (earnings data from StreetInsider):

- EXPE – EPS (miss) revenue (beat); opened down -1.61% and closed -2.67%

- TRIP – EPS (beat) revenue (beat) ; opened down -9.21% and closed -7.14%

- OWW – EPS (miss) revenue (beat); opened up 0.37% and closed +16.67%

- TZOO – EPS (beat) revenue (beat); opened up 4.11% and closed +24.31%

From a competitor standpoint it was a mix on EPS but all beat on revenue. The opening move seemed fairly mute except for TRIP, which saw buyers and hit highs within the first 30min of trading. PCLN was talked about stock on 8/8 when it saw a big gap down and closed near the lows. In this report it missed on revenues but more importantly it guided down for Q3’12 EPS (to which it ended up beating on Q3 release).

For further explanation of the excel tables and data in them please refer to this post.

Looking at the Augen StDev 1min After Open average it is showing 3.75. I like to take this multiplied by the current StDev Move Before Earnings which is showing 13.79.

3.75 * 13.79 = 51.71; this is my expected point move based on prior price action and volatility movements into earnings.

The next table shows implied volatility (IV) moves and looks at the ATM straddle to see what the option market is pricing (I prefer to use the bid for purposes of the worse possible fill). On the far right the green cells represent a win selling the straddle and the red cells represent a loss):

Looking at the data the 2 most recent earnings saw some of the biggest moves on a percentage basis and we are right about where we were back on the 8/7 earnings release in which PCLN saw its biggest move. Some other notes:

- Straddle (going off bid price) is pricing 7.2% move

- ATM Call IV is low comparing to past

- Except for 2 prior earnings the straddle sale has been very profitable and alternated quarters between a win or loss

To me selling volatility doesn’t seem like the better trade here. But I also think that the two prior earnings moves has many with that observation and I like to think when things become too obvious the opposite can happen.

So is volatility a sale? Given the data its a no in my opinion but now that a big move is expected, I believe the opposite will happen. Also the competitors stats have me leaning towards a volatility sale as well, especially when they have had previous big gaps on earnings yet recent release is fairly muted from close to open. I definitely would not sell a straddle unless you can afford a big loss. I personally like selling an Iron Condor (managed risk vs straddle sale).

Looking at the chart (notes on chart):

The chart above has yellow dashed lines showing where I want PCLN to stay within into Friday expiration. The trade I like:

Sell March1 620/625/735/740 Iron Condor for 1.92 credit, risk $308.

Below is the risk profile with red dashed lines representing a 10% move. In this trade I make a profit (at Friday expiration) if PCLN stays within -7.2% to the downside and +9.7% to the upside (all going off EOD data 2/25/2013):

Also you could come in on those strikes for a lower risk, lower probability trade. I like this trade as I am looking for volatility to be a sale and look for the price to stay contained. If I price action goes against my thoughts/expectations then this trade will probably be a loser. Personally I trade and would recommend trading earnings accepting a 100% loss as earnings trades are a gamble in where all you can control is your risk.

While I was absent from the markets on Friday there seemed to be much buzz about LVS in the social media space and across the options market. Much of the action in LVS options is attracted to the March and May option chains. A picture of the March chain is below:

This to me looks like a ratio spread to be confirmed by looking at open interest on Monday. In this spread the trader is buying the March 52.25 calls and selling twice as many March 55 calls for a net debit 0.69c. Also there was action in the May options chain as well. There was a big block of 17,397 calls on the ask for a 2.05 debit. All together the May 52.5 calls saw volume of 27,245 contracts vs open interest of 282. A picture of the T&S can be seen below:

Now that the options action has set the alert, it is time to look at the chart to see if the technicals align with the action:

In the chart we can that LVS has been in a downtrend (annoted by red bars) with a reversal bar (green bar). If LVS breaks above the high of the green bar there is a probability for a continued long trade. If it breaks below the low of the green bar then the downtrend is likely to resume. Note that this is all short-term price action in timeframe of a swing trade. On another note for the bullish side LVS saw a nice hammer candle on the 100ema on volume above average that was confirmed by Fridays candle on volume above average.

So what’s the trade?

In this scenario I like to look at the recent option action, especially the ratio spread. In this trade the trader is looking at the following risk profile with March expiration in mind:

In following this trade I would be looking at upside for LVS as this big trader is looking for it to close between 52.43 and 57.57 at March expiration. The furthest red-dashed line to the left represents current price. This risk profile combined with the May action as annotated above has me leaning bullish in LVS.

In following this trade I would be looking at upside for LVS as this big trader is looking for it to close between 52.43 and 57.57 at March expiration. The furthest red-dashed line to the left represents current price. This risk profile combined with the May action as annotated above has me leaning bullish in LVS.

My trade recommendation is an upside March call butterfly spread. I personally would trade the same ratio spread but for margin purposes I believe the butterfly spread offers much of the same opportunity without the same margin requirements. I like the March 52.5/55/57.5 call butterfly for a 0.19c debit (max loss $19). This captures approximately the same range for a reduced cost. Risk profile can be seen below:

I really like this trade from a risk:reward standpoint and that it actually follows the big trade that was put on in the March ratio spread. As always this trade is based on my thoughts and the individual trader is responsible for his/her decisions.

In my most recent post titled “Following the Trade – AAPL Trade Adjustment on Friday 2/15” I detailed the ongoing trade that I have on in AAPL. In this post I won’t go into full detail on the trade, reasons for, and adjustments but here are the links in chronological order of those details stated:

- 2/5 – Utilizing Market Comments From Other Traders (put on March 460-480-490 Call Broken Wing Butterfly (BWB) for 4.25 debit)

- 2/11 – Trade Adjustment – APPL (added Feb4/Feb 460 Put Calendar for 1.60 debit)

- 2/15 – Following the Trade – AAPL Trade Adjustment on Friday 2/15 (recap of all the trades and closed the Feb4/Feb 460 Put Calendar for 4.09 credit (+$249.00, +155.6%) and added Feb4/Mar1 440 Put Calendar for 1.69 debit)

Today I closed that Feb4/Mar1 440 Put Calendar in the morning for a 4.40 credit (+$271.00, 160.4%), trade order below:

I wanted to take advantage of the morning weakness and just close out this hedge to the main Broken Wing Butterfly that I had on. With the gains in the 2 calendar trades I put on, the remaining trade of the original BWB is a risk-free trade at a $95 credit. I do not plan to add anymore hedging strategies to this trade and instead will ride out the BWB more and likely to near expiration. In a perfect world AAPL would shoot past then retrace to the 480 level around March expiration, 22 days.

Below is the new risk profile, same look as the original trade with different risk/reward:

Now I sit and wait until March expiration. I could keep adding a hedging strategy but with those 2 calendar trades I am happy with the risk and will let AAPL do its thing leaving the long bias trade on. Below is a trade history:

In doing some reading after the market I came across an interesting post from Bespoke Investment Group titled Key ETF Performance. The table shows the performance of the ETF’s after yesterday’s decline in the markets. In looking at this table, it looks as if everything moved in alignment the way it is expected:

- Sectors – the worst performers were Energy and Materials while the best performers were Consumer Staples and Utilities (the flight to safer assets)

- Euro down and Yen up

- Japan was best global ETF performer while Russia, correlated to natural resources, was the worst performer

- Bonds, which are negative YTD, saw gains across the group

Picture courtesy of Bespoke Investment Group:

Even though it was the biggest down day of the year on volume above average, I like to see that these key ETF’s performed as expected on a macro scale.